For Enquiries

4 / 136 Stirling Hwy

North Fremantle,

Western Australia 6159

+61 8 9489 3500

ben at charnaud dot com dot au (Send us an email)

Property Syndicates

Port Hedland Boulevard Shopping Centre

This property was purchased for a number of investors eight years ago. During this time Port Hedland has experienced both growth and slump periods. Charnaud Macro has demonstrated strong asset management throughout and always provided a strong return for the investors. Most recently Charnaud Macro carried out a refurbishment program of the shopping centre and negotiated a new 20 year lease with Woolworths.

The syndicate is managed by Property Managers and monthly meetings are held. Charnaud Macro employs a “hands on” approach whereby we visit the property once every 2 – 3 months and have a strong relationship with BHP, the local Shire and with all our tenants. This has resulted in a 100% leased property with average returns of 12%. Significantly the current valuation is double the initial purchase price.

Syndicates

Charnaud Macro is a division that has been developed for the private investor to invest in a property syndicate. Although predominately these syndicated properties are in Western Australia, Charnaud has recently been appointed to secure assets for investors in the United Kingdom.

The current syndicates are all high performing investments. As is demonstrated in the table below, theses properties continue to perform extremely well through the strong asset and funds management skills of Charnaud Macro.

Charnaud Macro is always available to discuss and explore new opportunities for investors.

Please contact us for more information.

| Location | Purchase Price AUD $ | Current Valuation AUD $ | Distribution Yield |

| Port Hedland Boulevard | $7.15mil | $15mil (September 2010) | 12.25% |

| Officeworks Bunbury | $3.5mil | $4.74mil (July 2008) | 12% |

| Malaga Markets | $8.75mil | $16mil (September 2010) | 15.5% |

| Marketforce | $3.75mil | $8.01mil (June 2009) | 20% |

| Southern River Shopping Centre | $25.5mil | $26.5mil (June 2010) | 8% |

Malaga Markets

The Central Market stalls are situated in two wings either side of the Central Foodhall and Fresh Produce area. The west wing has a total tenancy area of approximately 611 square metres and the east wing is approximately 606 square metres, plus a cleaner’s store. The stalls vary in size from around 12 to 30 square metres although some of the tenancies incorporate numerous stalls.

Some 375 on-site car bays surround the development and are designed to encourage the use of all seven entry points to the markets.

Charnaud Macro has overseen all aspects of management and marketing, employing two Property Managers and eight staff at Malaga Markets. As the property management is not outsourced, the comprehensive “hands on” approach to management includes weekly onsite meetings, allowing for the establishment of direction in all areas of management, marketing and negations with tenants. Due to this approach Malaga Markets now enjoys a door count of approximately 35,000 per weekend and has virtually doubled in value over the last four-year period.

Marketforce

Marketforce Ltd is a large Marketing and Advertising group based in the excellent location of West Perth. This investment has performed extremely well. The property purchase price of the Marketforce office building was $3.75 million. The Marketforce building is now valued at $8 million, providing a current distribution on initial investment equating to a 33% per annum return.

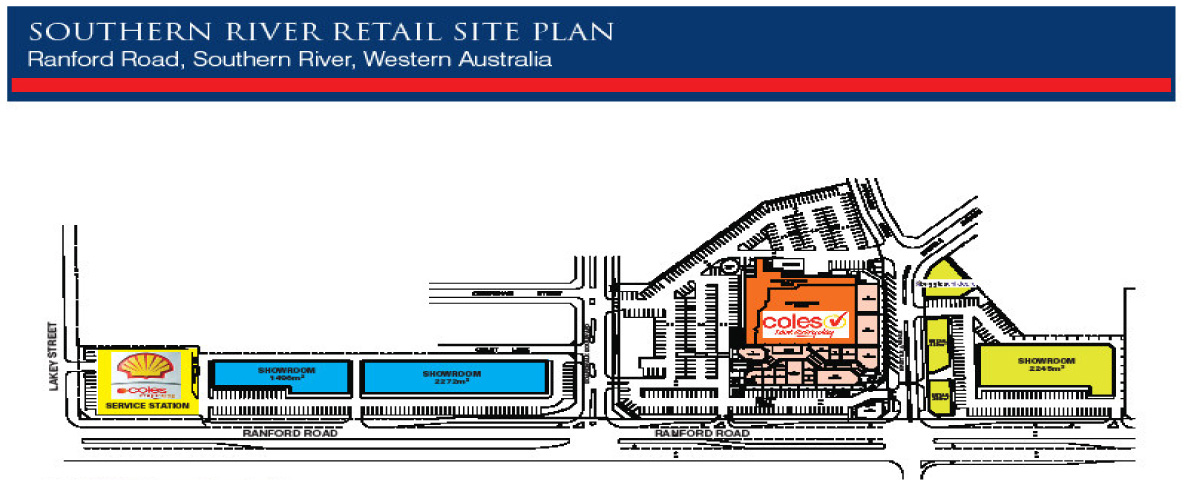

Southern River Shopping Centre and Showrooms

This property was purchased June 2010 for $25.5 million syndicated jointly with Primewest. Charnaud raised half the equity and is involved in the continued asset management. The Property is situated approximately 20 kilometres south of the Perth CBD in the developing suburb of Southern River. The suburb has been progressively developed over the last few years from mostly semi rural land uses to urban residential development in the form of predominantly single level detached dwellings on individual lots.

The Property was built in 2005 and comprises a neighbourhood shopping centre, strip shops, freestanding showroom buildings, a freestanding real estate agency office and a child care centre on 4ha of land. The gross lettable area of the entire centre is 12,333 m2 comprised of the following plus approximately 532 car bays.

| Shopping Centre | 4,958 m2 |

| Showroom A | 3,811 m2 |

| Showroom B | 3,308 m2 |

| Service Station | 256 m2 |

The Property is anchored by Coles and Liquorland who together contribute approximately 20% of the Property’s net income. As the Property and location mature there will be significant opportunity for rental growth in the Supermarket, Specialty Retail and Showroom rents.